Vinton.ai is a cutting-edge financial technology platform designed to elevate the functionality of Salesforce for financial services firms in Canada and the USA. The platform uses artificial intelligence (AI) and automation to streamline operations, optimize data management, and deliver personalized client experiences. By revitalizing the Activity Object in Salesforce, Vinton provides practical tools for capturing client interactions, automating administrative tasks, and ensuring compliance with data residency requirements.

Practical Benefits for Salesforce Customers in Financial Services

1. Seamless Integration with Salesforce Clouds:

- Vinton integrates seamlessly with Sales Cloud, Service Cloud, and Financial Services Cloud, ensuring that financial services firms can leverage its capabilities across different areas of their business. Whether it’s enhancing sales activities, improving customer service, or streamlining financial services workflows, Vinton helps automate tasks, log interactions, and provide AI-driven insights that drive productivity.

2. Revitalized Activity Management in Salesforce:

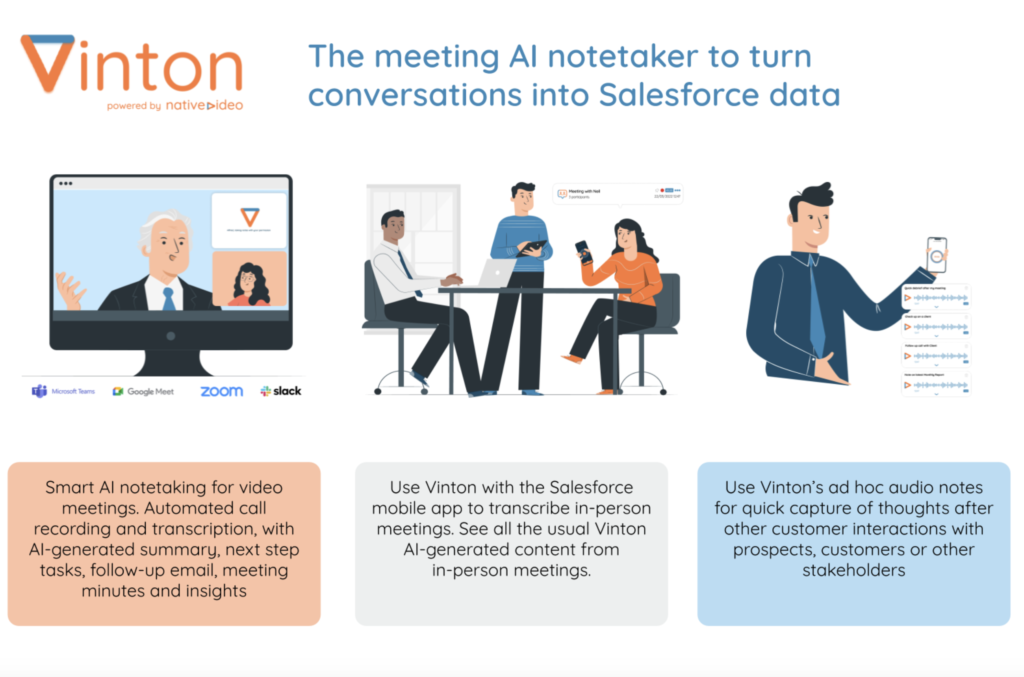

- Vinton breathes new life into the Salesforce Activity Object by making it much easier to log various types of client interactions, such as in-person meetings and virtual calls. The platform automatically recognizes participants and associates the meeting with relevant contacts, ensuring accurate records. This enhancement is especially valuable for financial advisors and professionals in wealth management, banking, and insurance who need to automate administrative tasks in financial services to stay efficient.

3. Boosts Efficiency for New Staff and Tenured Professionals:

- For new financial advisors, Vinton helps automate routine tasks, enabling them to plan their day more effectively and manage meeting notes. The platform significantly reduces administrative work, allowing experienced professionals to focus on the client rather than data entry. This combination of activity management automation for financial advisors with practical use of AI-driven meeting notes automation makes Vinton an invaluable tool for all experience levels.

4. Data Residency Compliance and Secure Storage:

- Vinton ensures data residency compliance by securely storing all interaction data within Salesforce. For financial services firms in Canada and the USA, addressing data residency and compliance is critical, especially under regulations such as PIPEDA (Personal Information Protection and Electronic Documents Act), CASL (Canada’s Anti-Spam Legislation), or the Gramm-Leach-Bliley Act in the USA. By keeping data within Salesforce, companies can meet these requirements while still benefiting from a seamless user experience.

5. Automated Meeting Notes and Follow-Up Tasks:

- The platform leverages AI to automate note-taking during meetings and create follow-up tasks based on discussions, reducing the risk of missed follow-ups. By integrating this practical use directly into Salesforce workflows, Vinton ensures that all client interactions are recorded with precision, providing a reliable source for comprehensive data management in financial services.

6. Scalability for Financial Services Firms of All Sizes:

- Whether for small advisory practices or large financial institutions, Vinton’s features support firms at all stages. The platform’s ability to scale as businesses grow ensures continued efficiency even as client bases expand, making it ideal for financial services firms in the USA and Canada.

For financial services firms looking to unlock the full potential of Salesforce and Vinton.ai, contact Navirum for a demo to see how automating administrative tasks and enhancing data management can add significant value to your firm. Navirum specializes in Salesforce consulting and provides the expertise needed to implement Vinton successfully.